Category: Feeds

-

COT Silver Report – August 8, 2025

COT Silver Report – August 8, 2025 Positions as of 5 August, 2025 Silver COT Report Fri, 08/08/2025 – 15:23

-

-

-

Breaking: U.S. has just imposed tariffs on 1kg & 100oz Gold Bars.

submitted by /u/OuncesApp [link] [comments]

-

-

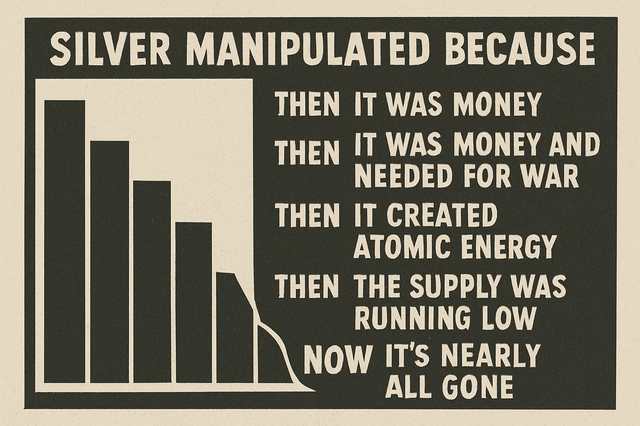

If JPMorgan Chase has historically suppressed the price of silver, then why/how would that ever stop?

submitted by /u/Megalitho [link] [comments]

-

-

-

-

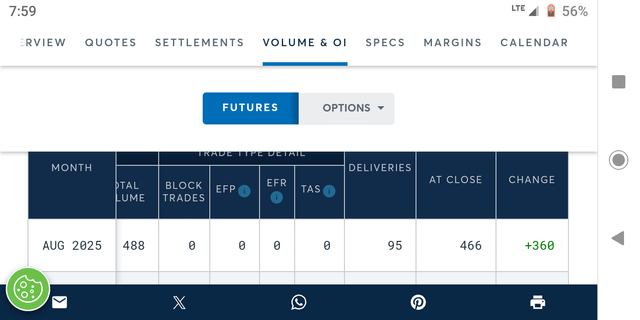

+1.7million oz. AG bought today for immediate delivery in Aug. contract

submitted by /u/motoware [link] [comments]

-

Silver Demand Surge to 50% of Global Production = 200 Moz Annual Deficit for Electrification Shift

The silver market is experiencing a fundamental transformation where industrial consumption has increased from 10% to 50% of annual production over the past century, creating a structural shift from primarily monetary metal to essential industrial commodity driven by electrification and renewable energy trends. A persistent supply-demand imbalance has emerged with annual deficits of approximately 200…

-

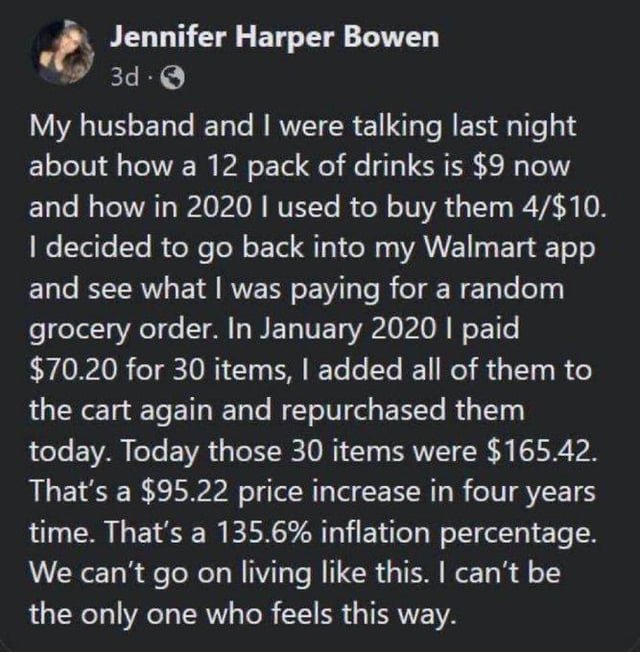

The Fed has abandoned all pretense of “tightening” and “fighting inflation” and is once again expanding the M2 money supply, stealing value from every honestly earned dollar in existence

submitted by /u/Boo_Randy_II [link] [comments]

-

Silver North: Cashed Up and Going Drilling

Silver North: Cashed Up and Going Drilling There are 12 kilometers of vein potential on the property; other discoveries include the high-grade West Fault. I like this project because it’s got standalone potential, or it could be plug into Hecla’s existing operation. Hecla has 55 million ounces of proven and probable silver reserves, SNAG is…

-

-

Repeal 1913

1913 was a fateful year for freedom in America. Both the Income Tax & Federal Reserve were created. The dreaded Income Tax made everyone’s hard earned money the property of the federal government first. The earnings that government allowed people to keep would then be persistently stolen by The Fed’s inflation. Freedom was put in…

-

-

Here’s What’s Happening in Gold & Silver Right Now

Here’s What’s Happening in Gold & Silver Right Now Gold and silver remain in consolidation, but their technical setups are still strong, despite the confusing crosscurrents caused by unpredictable tariff developments. Jesse Colombo Mon, 08/04/2025 – 09:45

-

Technical Scoop: Tariffs Reason, Golden Rebound, Dollar Tumble

Technical Scoop: Tariffs Reason, Golden Rebound, Dollar Tumble Earlier we had noted our nervousness over the fact that both silver and platinum made new highs but gold did not. A divergence…Now they both broke a support line but gold held. David Chapman Mon, 08/04/2025 – 09:40

-

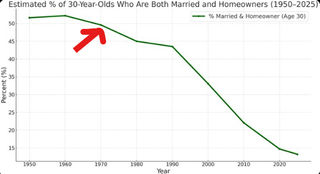

Only 12% of 30 year olds are married and own a home. This really started getting bad in 1971. That is when Nixon removed the US from the gold standard. That enabled the Congress and the Fed to start spending massive amounts, funded by debt and the Fed monetary policy.

By every measure, life has gotten worse since 1971 and the end of the gold standard. submitted by /u/Boo_Randy_II [link] [comments]

-

Sprott analyst Maria Smirnova “The available inventory of freely traded silver has been heavily diminished, making the metal more sensitive to incremental buying. Small increases in demand could now lead to disproportionately large increases in price,” she wrote.

According to Sprott analyst Maria Smirnova, silver remains “undervalued” relative to gold. “On average, gold has historically been priced at 67x the price of silver. With the current ratio at 91, silver is selling at a strong discount to gold,” she said, adding that silver is mined at only 7:1 compared to gold. “With less…