Category: Feeds

-

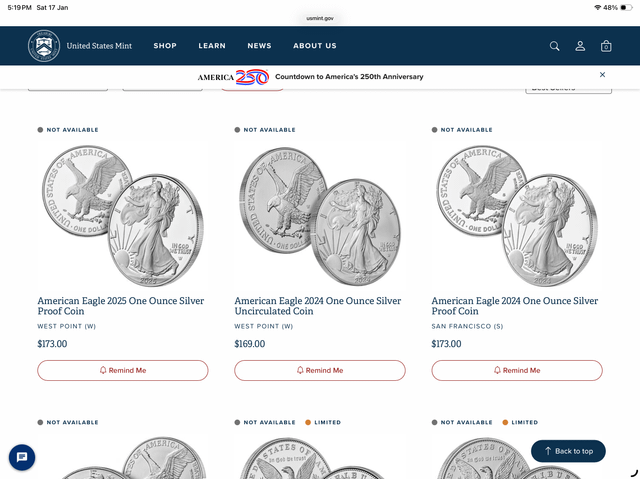

Hey, if The USMint prices an Eagle at $169. They are confirming the SILVER price in 2026 is well over $100/oz and not going down, And what are they seeing?

submitted by /u/OtaraMilclub [link] [comments]

-

WTF! The U.S. Mint just updated the price to 169/oz!!! 🚀🚀🚀

submitted by /u/Stimul8ed [link] [comments]

-

Silver Goes Vertical: Do You Have An Exit Plan?

Silver Goes Vertical: Do You Have An Exit Plan? | https://www.themorganreport.com As silver continues to move, it won’t creep higher. It will accelerate. History shows that the most dramatic gains occur in a compressed window, when volatility spikes, emotions run hot, and rational decision making becomes difficult. This is the phase where fortunes are made…

-

COT Silver Report – January 16, 2026

COT Silver Report – January 16, 2026 Positions as of 13 January, 2026 Silver COT Report Fri, 01/16/2026 – 15:29

-

Silver’s Extreme Parabola

Silver’s Extreme Parabola Traders should avoid chasing silver’s popular-speculative-mania gains, and gird for an imminent big-and-fast selloff. Adam Hamilton Fri, 01/16/2026 – 13:28

-

Impact of New Chinese Silver Export Regulations Overstated

Impact of New Chinese Silver Export Regulations Overstated The impact of Chinese silver export rules won’t be as significant as many initially thought. Mike Maharrey Fri, 01/16/2026 – 08:50

-

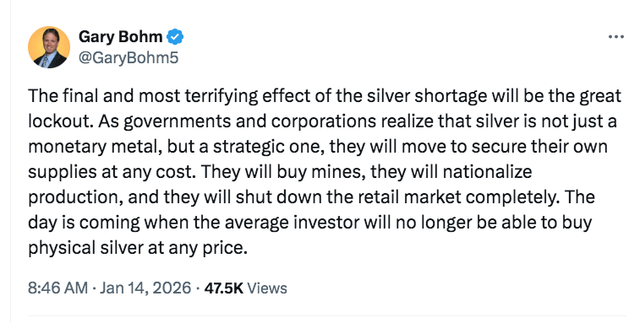

Seven Risks For Silver Investors To Pay Attention To

Seven Risks For Silver Investors To Pay Attention To The recent move in silver has unsettled a lot of people. It has unsettled people not because of the price itself, but because it no longer behaves the way many expected it to. David Russell Fri, 01/16/2026 – 08:00

-

Silver Dips After US Tariff Pause, But Set for Hefty Weekly Gain +14% (Bloomberg)

Silver Dips After US Tariff Pause, But Set for Hefty Weekly Gain +14% (Bloomberg) SilverSeek Fri, 01/16/2026 – 07:56

-

Silver’s Rally Slams Solar Makers Struggling With Losses (Bloomberg)

Silver’s Rally Slams Solar Makers Struggling With Losses (Bloomberg) SilverSeek Fri, 01/16/2026 – 05:13

-

Silver Dips After US Tariff Pause, But Set for Hefty Weekly Gain (Bloomberg)

Silver Dips After US Tariff Pause, But Set for Hefty Weekly Gain (Bloomberg) SilverSeek Fri, 01/16/2026 – 05:11

-

-

-

Silver is getting more expensive to trade, but it could still hit $100. Here’s how. (MarketWatch)

Silver is getting more expensive to trade, but it could still hit $100. Here’s how. (MarketWatch) SilverSeek Thu, 01/15/2026 – 13:01

-

White House declares critical mineral dependence a national security threat; issues 180-day ultimatum for trade deals before potential tariffs.

submitted by /u/DumbMoneyMedia [link] [comments]

-

Gold $5,000 and Silver $100: The 2026 Crisis Signal

Gold $5,000 and Silver $100: The 2026 Crisis Signal Experts anticipate silver recovering to new all-time highs above $80. Maharrey says the bigger story is not a short-term pullback, but the supply squeeze underneath the entire market. MoneyMetals Thu, 01/15/2026 – 08:00

-

Silver Retreats After Rally as Trump Holds Off on Mineral Tariffs (Bloomberg)

Silver Retreats After Rally as Trump Holds Off on Mineral Tariffs (Bloomberg) SilverSeek Thu, 01/15/2026 – 07:30

-

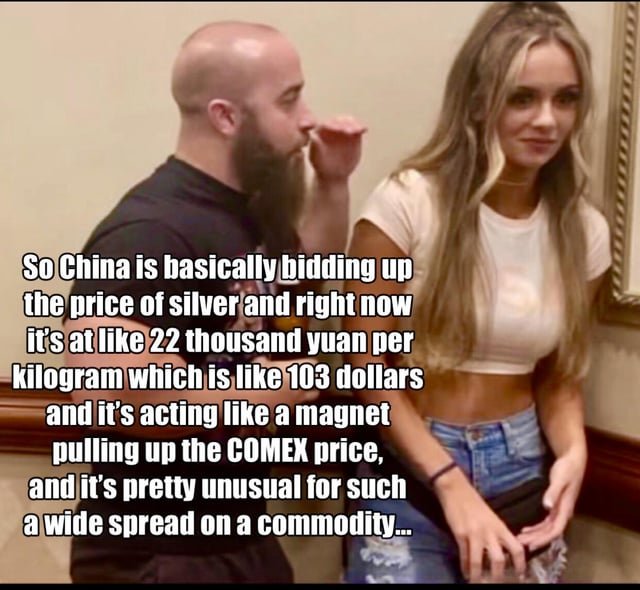

Banskters Dump 10,000 Short SI Contracts in 15 Minutes to Suppress Prices in Overnight Trading Hours – They Deserve Everything Coming to Them

More contracts sold in 15 minutes in late after hours trading than this morning’s regular market’s opening first 15 minutes today. They are beyond desperate. submitted by /u/1Krush [link] [comments]

-

-

-

Physical Metal Beats All Other Safe Havens

Physical Metal Beats All Other Safe Havens | https://www.themorganreport.com David Morgan discusses the current surge in silver prices and explains why he believes the market has entered true price discovery driven by geopolitical stress, currency instability, and weakening confidence in debt markets. He warns viewers about the explosion of AI generated silver content that mixes…