It looks like the world is finally waking up. Fiat currency issuance is growing exponentially, and prices across the board are rising. Precious metals remain an anchor of stability — a reminder of where real money still is.

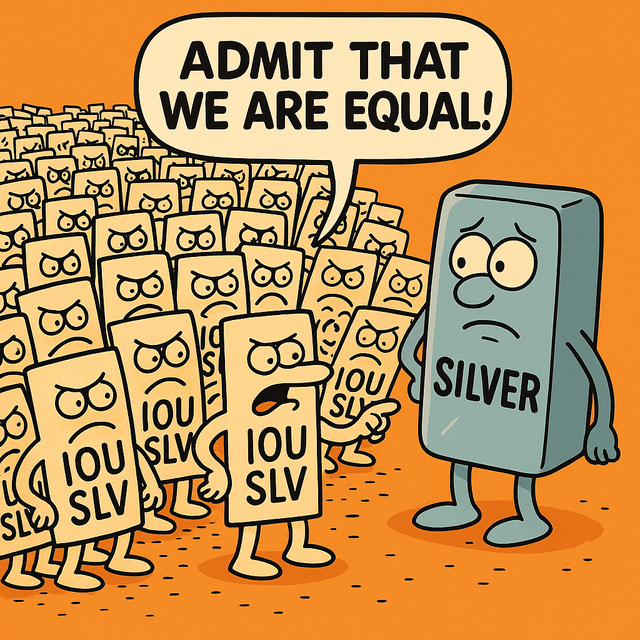

The problem is the paper scam on futures markets. Much of what trades there is not real metal: people think they’re buying silver, but in many cases they’re only holding IOUs — uncovered promises to deliver. That worked as long as delivery wasn’t demanded. Eventually, however, those promises must be honored, and the gap between paper claims and physical metal becomes obvious.

The paper:physical ratio can be calculated in different ways, but it’s almost certainly much higher than most people realize. Some precious-metals ETFs are audited in theory, but even many market participants don’t seem to fully trust the reported numbers.

I’ve seen various calculations — based on open interest vs. registered inventory, on futures transaction estimates, and more. Most of them show ratios far above 1:250; some estimates even reach 1:400. If you include other derivatives, options, and leveraged bets, a single physical ounce can be the basis for many more paper claims. At that point, it’s mostly paper. Digitalized like BTC or other kind of fraud.

Who should be blamed? Regulators almost certainly know about these imbalances, market participants are aware, and yet verification appears weak or sporadic.

We all know silver is relatively scarce — possibly less available above ground than gold — and it may be only a matter of time before that reality becomes widely accepted.

PS — the attached picture was generated by me here; feel free to use it where you want. 😉

submitted by /u/AlustTheTrue

[link] [comments]

Leave a Reply