-

Silver North Signs Significant Drill and Geophysical Contracts for 2026 Silver Exploration at Haldane, YT

Silver North Signs Significant Drill and Geophysical Contracts for 2026 Silver Exploration at Haldane, YT CEO Weber: “With two drills available to us, we now have the flexibility to simultaneously test our numerous exploration targets on the Haldane Project.” Silver North R… Mon, 03/09/2026 – 08:37

-

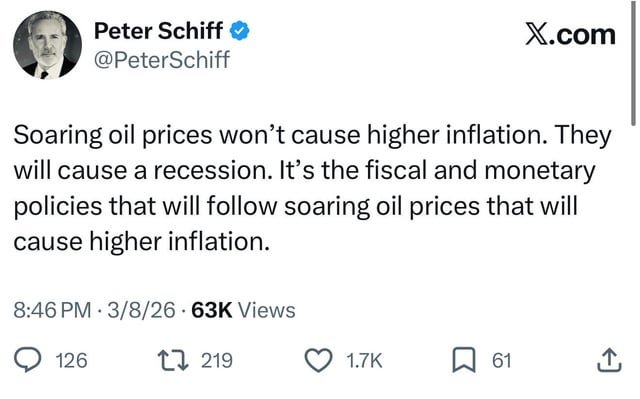

Technical Scoop: Oil Reliance, Gold Link, Hormuz Impact

Technical Scoop: Oil Reliance, Gold Link, Hormuz Impact How long will this corrective period last? Typically, this period is weak for gold and silver with bottoms usually seen in June or even July. A February top is not unusual… David Chapman Mon, 03/09/2026 – 08:00

-

The Acceleration Phase Is Here | Gold Silver Strategy 2026

The Acceleration Phase Is Here | Gold Silver Strategy 2026 | https://www.themorganreport.com Today, Stacking Surfer provides an update on market acceleration, featuring insights from the Morgan Report. David Morgan discusses the potential for significant gains in gold and silver, emphasizing the current acceleration phase. He highlights past spectacular gains in precious metals and suggests that…

-

The federal reserve act was the beginning of the end for the American empire.

submitted by /u/Silver-Honkler [link] [comments]

-

COT Silver Report – March 6, 2026

COT Silver Report – March 6, 2026 Positions as of 3 March, 2026 Silver COT Report Fri, 03/06/2026 – 15:34

-

Above Ground Silver -vs- Market Supply: Understanding the Real Price Driver

Above Ground Silver -vs- Market Supply: Understanding the Real Price Driver | https://www.themorganreport.com David Morgan reviews research from the Silver Institute examining the relationship between above-ground silver stocks and the price of silver. At first glance, the study’s conclusion appears counterintuitive because it states that there is no clear correlation between the total amount of…

-

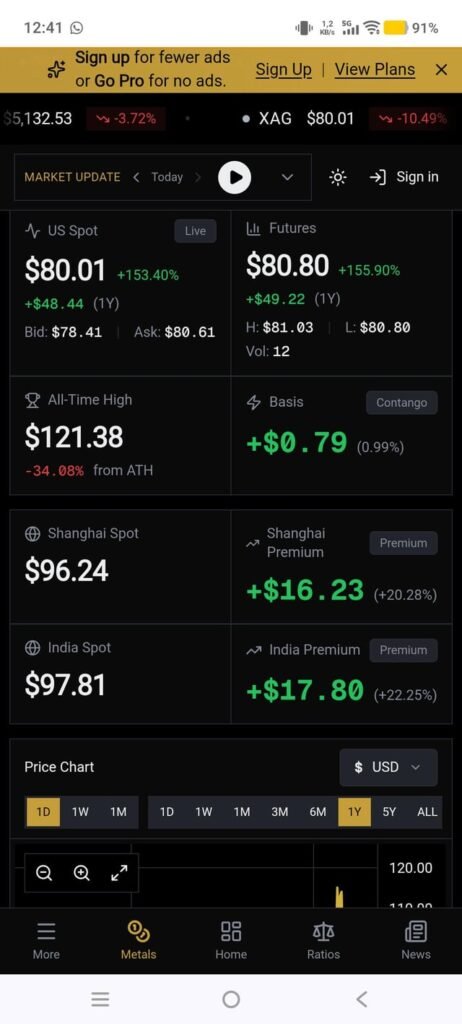

This looks like a manipulated market on the verge of breaking.

submitted by /u/Extension-Spell2678 [link] [comments]

-

Silver Market on Edge: COMEX Faces Unprecedented Delivery Stress in March Cycle

keep draining physical. They are showing how desperate they are by their paper take downs. It just confirms they are in deep shit. When the west attacks the east stacks. Their paper attacks back fire because it helps drain even more physical. Keep stacking even if it’s 1oz at a time. India, China should make…

-

Why Gold and Silver Fall When War Begins

One of the more confusing moments for investors in the precious metals sector occurs when geopolitical conflict erupts and gold and silver fall instead of rallying. Many people instinctively believe that war should send safe-haven assets straight up. When the opposite occurs, it casts doubt on the metals themselves. The mainstream financial press typically explains…

-

Seven Silver Investing Mistakes

Seven Silver Investing Mistakes New investors often arrive at silver during moments of heightened attention, interpreting volatility as validation of a narrative rather than as a characteristic of the asset itself. David Russell Wed, 03/04/2026 – 08:15

-

Note from a 90 yo ape

A friend of our’s wife passed away recently and he has to move into his daughter’s place in another state. He has a crapload of silver rounds and we got those appropriately stored first thing (see one of my previous posts). My wife was over there helping clean up today and found this. I knew…

-

Silver, Strategy, and a Structural Deficit

Silver, Strategy, and a Structural Deficit Charlie Garcia noted that 60 to 70% of the globally traded refined silver supply now requires Chinese permission to be exported…that shift alone changes the strategic landscape. MoneyMetals Tue, 03/03/2026 – 08:23

-

BP Silver Intersects Bonanza Grade Silver at the Cosuño Silver Project, a Tier-1 Silver Discovery?

BP Silver Intersects Bonanza Grade Silver at the Cosuño Silver Project, a Tier-1 Silver Discovery? BP Silver Intersects Bonanza Grade Silver at the Cosuño Silver Project — The new silver exploration company released the final batch of results from a Phase-1 drill program to test the near-surface mineralization potential of the lithocap — 11 drill…

-

Gold to $10K — Central Banks Led the Way, Now Wall Street Is Catching Up

Gold to $10K — Central Banks Led the Way, Now Wall Street Is Catching Upm | https://www.themorganreport.com In this 10 minute video, David Morgan shares his updated gold target of at least $10,000, explains why Wall Street figures who once dismissed precious metals are now recommending significant gold allocation, and breaks down what central bank…