-

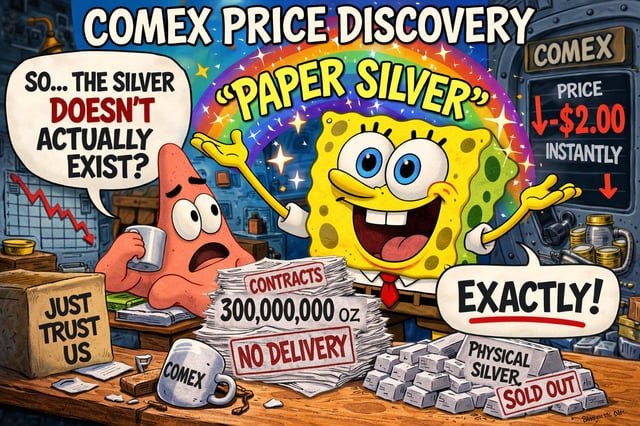

KRUSTY KRAB MENU

Krabby Patty: $5 Krabby Patty FUTURES: $0.03 Delivery Optional submitted by /u/IlluminatedApe [link] [comments]

-

I just want to say thank you to all of you. I learn a lot from everyone here. We are some of the few people that questions what is going on. Big ups, Bob

submitted by /u/Bobshotsauce [link] [comments]

-

Why Gold & Silver Haven’t Rallied After Breakout of Iran War

Why Gold & Silver Haven’t Rallied After Breakout of Iran War My suspicion is that this ultimately ends up playing out in similar fashion to what we saw with the confirmation of silver as a critical mineral. Chris Marcus Wed, 03/11/2026 – 09:32

-

OIL Spike lead’s to recession

Not a huge fan of Peter Schiff but he has this one right. Oil spiking in this economy will lead us to a recession. A recession will lead to gold silver and the entire stock market to be in a overall bear market. You can not have an economic boom with high oil prices. Transportation…

-

This and nine 1 oz coins – overall 10 oz as a 17 years old – what do you think

submitted by /u/Fair_Appointment_467 [link] [comments]

-

What Most Investors Get Dead Wrong About Precious Metals

What Most Investors Get Dead Wrong About Precious Metals | https://www.themorganreport.com In this episode, Jim Oliver sits down with David Morgan, founder of The Morgan Report, to discuss the realities behind precious metals investing and why most investors misunderstand the sector. David shares how his early career in engineering and finance led him to question…

-

Btw why are prices going up again? Did something happen?

submitted by /u/Aeronquezzs [link] [comments]

-

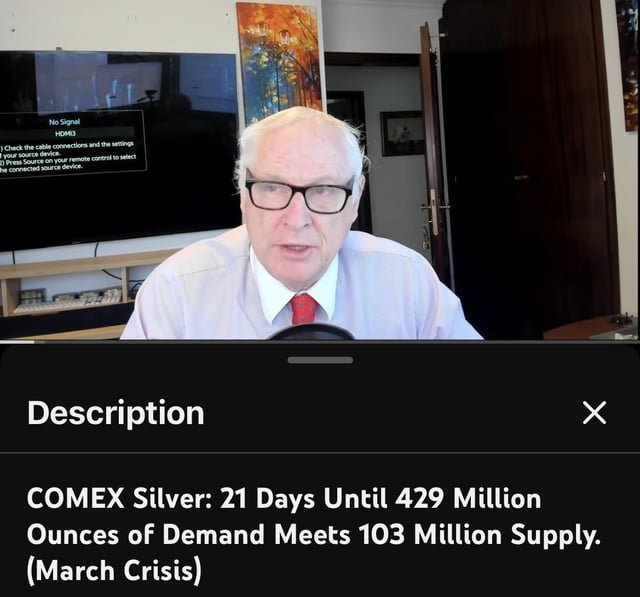

Silver Demand Expected to Outstrip Supply and Other Silver News

Silver Demand Expected to Outstrip Supply and Other Silver News The Silver Institute expects the global economic and geopolitical environment to continue supporting precious metals this year. Mike Maharrey Tue, 03/10/2026 – 09:30

-

Was this just BS?

Clive Thompson said the Comex would fail in March. He said 98% of demand was standing for delivery. Now he’s silent on the topic. Is he a BS artist? submitted by /u/Romulus1300 [link] [comments]

-

Silver North Signs Significant Drill and Geophysical Contracts for 2026 Silver Exploration at Haldane, YT

Silver North Signs Significant Drill and Geophysical Contracts for 2026 Silver Exploration at Haldane, YT CEO Weber: “With two drills available to us, we now have the flexibility to simultaneously test our numerous exploration targets on the Haldane Project.” Silver North R… Mon, 03/09/2026 – 08:37

-

Technical Scoop: Oil Reliance, Gold Link, Hormuz Impact

Technical Scoop: Oil Reliance, Gold Link, Hormuz Impact How long will this corrective period last? Typically, this period is weak for gold and silver with bottoms usually seen in June or even July. A February top is not unusual… David Chapman Mon, 03/09/2026 – 08:00

-

The Acceleration Phase Is Here | Gold Silver Strategy 2026

The Acceleration Phase Is Here | Gold Silver Strategy 2026 | https://www.themorganreport.com Today, Stacking Surfer provides an update on market acceleration, featuring insights from the Morgan Report. David Morgan discusses the potential for significant gains in gold and silver, emphasizing the current acceleration phase. He highlights past spectacular gains in precious metals and suggests that…

-

The federal reserve act was the beginning of the end for the American empire.

submitted by /u/Silver-Honkler [link] [comments]

-

COT Silver Report – March 6, 2026

COT Silver Report – March 6, 2026 Positions as of 3 March, 2026 Silver COT Report Fri, 03/06/2026 – 15:34

-

Above Ground Silver -vs- Market Supply: Understanding the Real Price Driver

Above Ground Silver -vs- Market Supply: Understanding the Real Price Driver | https://www.themorganreport.com David Morgan reviews research from the Silver Institute examining the relationship between above-ground silver stocks and the price of silver. At first glance, the study’s conclusion appears counterintuitive because it states that there is no clear correlation between the total amount of…

-

This looks like a manipulated market on the verge of breaking.

submitted by /u/Extension-Spell2678 [link] [comments]